Source Identifier | Definition

At WWDC 2022, Apple announced updates to the fourth generation (v4.0) of its SKAdNetwork. Source Identifier, a 4-digit value, will replace the existing 2-digit Campaign ID in SKAdNetwork 4.0.

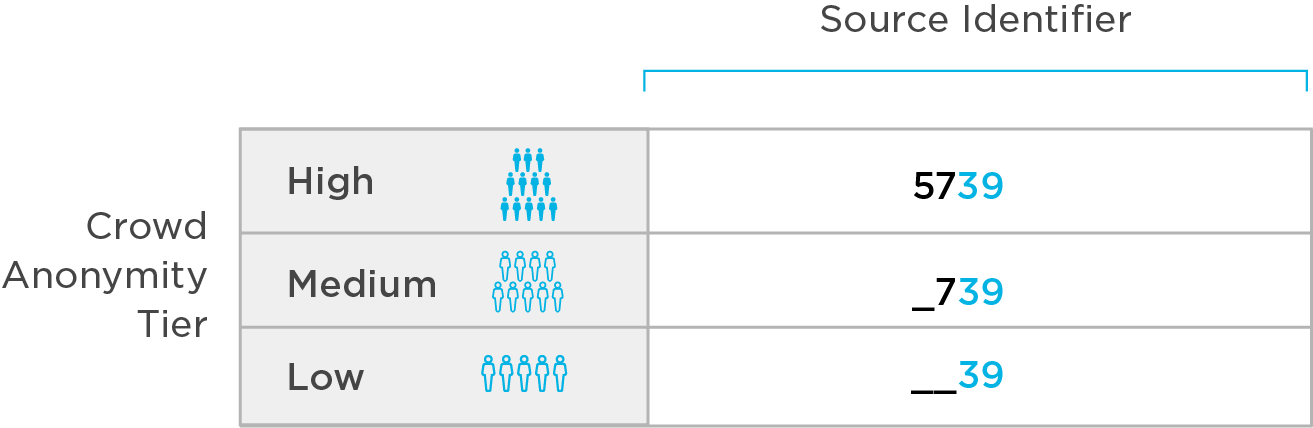

The Source Identifier can be thought of as the ‘conversion value’ equivalent for identifying the attributes of an ad impression served by an Ad Network. The last 2 digits are available at the lowest crowd anonymity tier, while the 3rd and 4th digits only become available at the medium and high crowd anonymity tier respectively. Apple recommends the last 2 digits be used for Campaign ID, but publishers and ad networks will have autonomy to decide how they utilize each digit.

Digit #4 = Ad placement bucket

Digit #3 = Date bucket

Digit #1,2 = Campaign ID

Related Terms

Coarse Grained Value

Crowd Anonymity Tiers

Fine Grained Value